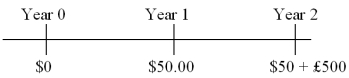

Find the value today of a 2-year dual currency bond with annual coupons (paid in U.S.dollars at a 5 percent coupon rate) that pays £500 per $1,000 par value at maturity.The cash flows of the bond are:  The dollar-based yield to maturity is i$ = 3%; the spot exchange rate is $1.80 = £1.00; the pound-based yield to maturity is i£ = 4%.

The dollar-based yield to maturity is i$ = 3%; the spot exchange rate is $1.80 = £1.00; the pound-based yield to maturity is i£ = 4%.

Definitions:

Clinical Decision

A judgment made by healthcare professionals based on a comprehensive assessment of patient information and evidence to guide patient care and treatment.

Defense Mechanism

Psychological strategies unconsciously used to protect oneself from anxiety arising from unacceptable thoughts or feelings.

Overusing

The excessive or improper use of something, which can lead to undesirable effects or depletion of resources.

Behavior

The actions or reactions of an individual, in response to external or internal stimuli, visible to others.

Q8: Calculate the euro-based return an Italian investor

Q13: Public traders do not trade directly with

Q25: Severe imperfections in the labor market lead

Q26: Price discovery in the secondary stock markets<br>A)occurs

Q33: In which type of market can liquidity

Q36: Which state has a comparative advantage in

Q58: Consider a plain vanilla interest rate swap.Firm

Q64: The Toronto Stock exchange<br>A)is fully automated.<br>B)features electronic

Q72: Country A can produce 10 yards of

Q96: A stop-limit order is an order to