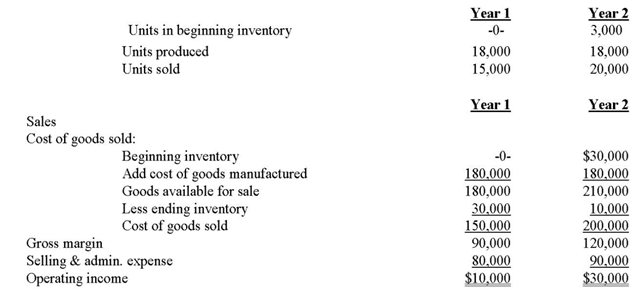

Operating data for Fowler Company and its absorption costing income statements for the last two years are presented below:

Variable manufacturing costs are $6 per unit. Fixed manufacturing overhead totals $72,000 in each year. This overhead is applied at the rate of $4 per unit. Variable selling and administrative expenses were $2 per unit sold.

Required:

a) What was the unit product cost in each year under variable costing?

b) Prepare new income statements for each year using variable costing.

c) Reconcile the absorption costing and variable costing operating income for each year.

Definitions:

West Africa

A region in Africa that includes countries such as Nigeria, Ghana, Senegal, and others, known for its diverse cultures, languages, and history.

Stemplot

A graphical representation used in statistics to display quantitative data, showing their frequency of occurrence.

Forest Fires

Uncontrolled fires that occur in wooded areas, potentially causing widespread damage to ecosystems, properties, and human life.

Distribution

The way in which something is shared out or spread across a range, often referring to the probability distribution of a variable.

Q37: The following monthly budgeted data is available

Q41: (Appendix 5A)In an action analysis report prepared

Q68: What is the company's margin of safety

Q70: An allocated portion of fixed manufacturing overhead

Q74: What was the fixed overhead budget variance

Q87: North Company sells a single product.The product

Q93: The following is last month's contribution format

Q103: Shipping expense is $9,000 for 8,000 kilograms

Q131: Budgeted sales in Allen Company over the

Q140: How much overhead was applied to products