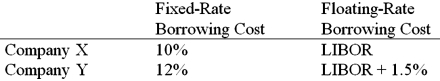

Company X wants to borrow $10,000,000 floating for 5 years; company Y wants to borrow $10,000,000 fixed for 5 years. Their external borrowing opportunities are shown below:  A swap bank proposes the following interest only swap: X will pay the swap bank annual payments on $10,000,000 with the coupon rate of LIBOR - 0.15%; in exchange the swap bank will pay to company X interest payments on $10,000,000 at a fixed rate of 9.90%. What is the value of this swap to company X?

A swap bank proposes the following interest only swap: X will pay the swap bank annual payments on $10,000,000 with the coupon rate of LIBOR - 0.15%; in exchange the swap bank will pay to company X interest payments on $10,000,000 at a fixed rate of 9.90%. What is the value of this swap to company X?

Definitions:

Sales Dollars

The total revenue generated from the sale of goods or services, often measured within a specific period.

Total Period Cost

Refers to the sum of all costs associated with production and operations for a specific period.

Variable Costing

An accounting method that assigns only variable production costs to products - those costs that fluctuate with the level of production, such as raw materials and labor.

Unit Product Cost

The total cost (direct materials, direct labor, and manufacturing overhead) divided by the number of units produced.

Q14: The J. P. Morgan and Company Global

Q15: Recent studies show that when investors control

Q18: Who benefits from debt-for-equity swaps?<br>A)The creditor bank<br>B)The

Q27: Calculate the euro-based return an Italian investor

Q36: In a study of the effect of

Q52: Shareholders of U.S. targets experience higher wealth

Q56: FOR YOUR SWAP (the one you have

Q72: Standard & Poor's has for years provided

Q95: The secondary stock markets<br>A)are the markets for

Q99: Zero-coupon bonds issued in 2006 are due