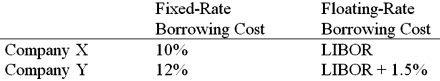

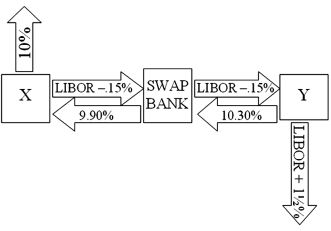

Company X wants to borrow $10,000,000 floating for 5 years; company Y wants to borrow $10,000,000 fixed for 5 years. Their external borrowing opportunities are shown below:  A swap bank proposes the following interest only swap: X will pay the swap bank annual payments on $10,000,000 with the coupon rate of LIBOR - 0.15%; in exchange the swap bank will pay to company X interest payments on $10,000,000 at a fixed rate of 9.90%. Y will pay the swap bank interest payments on $10,000,000 at a fixed rate of 10.30% and the swap bank will pay Y annual payments on $10,000,000 with the coupon rate of LIBOR - 0.15%.

A swap bank proposes the following interest only swap: X will pay the swap bank annual payments on $10,000,000 with the coupon rate of LIBOR - 0.15%; in exchange the swap bank will pay to company X interest payments on $10,000,000 at a fixed rate of 9.90%. Y will pay the swap bank interest payments on $10,000,000 at a fixed rate of 10.30% and the swap bank will pay Y annual payments on $10,000,000 with the coupon rate of LIBOR - 0.15%.  What is the value of this swap to the swap bank?

What is the value of this swap to the swap bank?

Definitions:

Current Assets

Assets that are expected to be converted into cash, sold, or consumed within a year or less, including stocks, receivables, and inventory.

Current Asset

Short-term assets that are expected to be converted into cash within one year or within the business's operating cycle.

Shareholders' Equity

Refers to the residual interest in the assets of a corporation after deducting liabilities, indicating the net worth available to shareholders.

Q3: XYZ Corporation, a U.S. parent firm, has

Q18: Fill out the following figure with the

Q25: The stock market of country A has

Q33: A "primary" stock market is<br>A)a big internationally-important

Q33: The Eurocurrency market<br>A)is only in Europe.<br>B)is an

Q48: Country risk<br>A)is a broader measure of risk

Q70: Compute the payments due in the second

Q75: Dealers in an OTC market<br>A)stand ready to

Q85: Some of the risks that a U.S.

Q85: Exchange rate fluctuations contribute to the risk