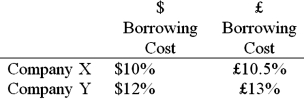

Company X wants to borrow $10,000,000 floating for 5 years; company Y wants to borrow £5,000,000 fixed for 5 years. The exchange rate is $2 = £1 and is not expected to change over the next 5 years. Their external borrowing opportunities are:  A swap bank wants to design a profitable interest-only fixed-for-fixed currency swap. In order for X and Y to be interested, they can face no exchange rate risk

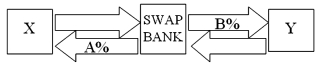

A swap bank wants to design a profitable interest-only fixed-for-fixed currency swap. In order for X and Y to be interested, they can face no exchange rate risk  What must the values of A and B in the graph shown above be in order for the swap to be of interest to firms X and Y?

What must the values of A and B in the graph shown above be in order for the swap to be of interest to firms X and Y?

Definitions:

Economic Growth

is the increase in the inflation-adjusted market value of the goods and services produced by an economy over time, typically measured by GDP.

1933-1940

A specific time period noted for significant global and political events, including the depths of the Great Depression and the lead-up to World War II.

Percent

A part or other object per hundred, used in mathematics and statistics to describe proportions.

Political Trends

Prevailing directions or patterns of change within the political landscape, reflecting shifts in public opinion, policy-making, and electoral behavior over time.

Q3: Adler and Simon (1986) examined the exposure

Q7: The vast majority of new international bond

Q22: Simplify the following set of intra company

Q24: Suppose your firm needs to raise €100,000,000

Q27: The floor value of a convertible bond<br>A)is

Q52: Translation exposure,<br>A)is not entity specific, rather it

Q53: Company X wants to borrow $10,000,000 floating

Q56: Suppose that the firm's cost of capital

Q65: Calculate the increase in annual after-tax profits

Q85: Exchange rate fluctuations contribute to the risk