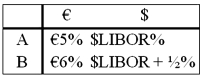

Come up with a swap (exchange of interest and principal) for parties A and B who have the following borrowing opportunities.  The current exchange rate is $1.60 = €1.00. Company "A" is in Milan, Italy and wishes to borrow $1,000,000 at a floating rate for 5 years and company "B" is a U.S. firm that wants to borrow €625,000 for 5 years at a fixed rate of interest. You are a swap dealer. Quote A and B a swap that makes money for all parties and eliminates exchange rate risk for both A and B

The current exchange rate is $1.60 = €1.00. Company "A" is in Milan, Italy and wishes to borrow $1,000,000 at a floating rate for 5 years and company "B" is a U.S. firm that wants to borrow €625,000 for 5 years at a fixed rate of interest. You are a swap dealer. Quote A and B a swap that makes money for all parties and eliminates exchange rate risk for both A and B

Definitions:

Nervous Tissue

A class of tissue comprised of neurons and supporting cells that specializes in communication throughout the body.

Vasopressin

A hormone released by the pituitary gland that regulates the body's retention of water and constricts blood vessels.

Antidiuretic Hormone

A hormone released by the pituitary gland that signals the kidneys to increase water reabsorption in the blood, thereby controlling the water balance in the body.

Potassium Secretion

The process by which cells actively transport potassium ions out of the cell or into the extracellular fluid or lumen of an organ.

Q10: The required return on equity for a

Q12: A swap bank has identified two companies

Q18: Today is January 1, 2009. The state

Q51: Floating-rate notes (FRN)<br>A)experience very volatile price changes

Q61: Under the investment dollar premium system,<br>A)U.K. residents

Q63: An interest-only currency swap has a remaining

Q65: The Wall Street Journal publishes daily values

Q94: Assume that XYZ Corporation is a leveraged

Q96: Find the NPV in euro for the

Q97: Solve for the weighted average cost of