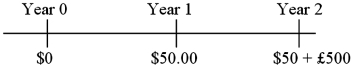

Find the value today of a 2-year dual currency bond with annual coupons (paid in U.S. dollars at a 5 percent coupon rate) that pays £500 per $1,000 par value at maturity. The cash flows of the bond are:  The dollar-based yield to maturity is i$ = 3%; the spot exchange rate is $1.80 = £1.00; expected inflation over the next three years is π$ = 2% in the U.S. and π£ = 3% in the U.K.

The dollar-based yield to maturity is i$ = 3%; the spot exchange rate is $1.80 = £1.00; expected inflation over the next three years is π$ = 2% in the U.S. and π£ = 3% in the U.K.

Definitions:

Accumulated Depreciation

The cumulative sum of depreciation costs recorded for a fixed asset since its initial use.

Patents

Exclusive rights to produce and sell goods with one or more unique features.

Net Income

The total profit or loss a company generates from its operations over a specific period after all expenses have been subtracted from revenues.

Operating Activities

The element of a company's cash flow statement that represents the cash flow from regular business operations.

Q8: Suppose you observe the following 1-year interest

Q19: You are a bank and your customer

Q26: A foreign country could provide low cost

Q29: A fully diversified U.S. portfolio is about<br>A)75

Q47: Examples of "single-currency interest rate swap" and

Q54: Assume that XYZ Corporation is a leveraged

Q70: The exposure coefficient in the regression <img

Q74: Why would a U.S. bank open a

Q75: A bank may establish a multinational operation

Q94: Calculate the euro-based return an Italian investor