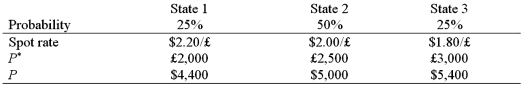

A U.S. firm holds an asset in Great Britain and faces the following scenario:  where,

where,

P* = Pound sterling price of the asset held by the U.S. firm

P = Dollar price of the same asset

-The variance of the exchange rate is:

Definitions:

Operating Cycle

The duration of time from the purchase of raw materials to the collection of receivables resulting from sales.

Q2: The variance of the exchange rate is:<br>A)0.0200<br>B)0.10<br>C)0.002<br>D)none

Q4: The €/$ spot exchange rate is $1.50/€

Q8: If you borrowed €1,000,000 for one year,

Q29: A MNC seeking to reduce transaction exposure

Q32: The underlying principle of the current/noncurrent method

Q43: A Japanese IMPORTER has a $1,250,000 PAYABLE

Q53: The turnover ratio percentages for 27 equity

Q58: Consider a U.S.-based MNC with a wholly-owned

Q60: True or false: floating rate notes behave

Q83: Operating exposure can be defined as<br>A)the link