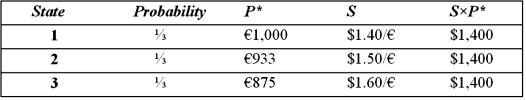

Suppose a U.S. firm has an asset in Italy whose local currency price is random. For simplicity, suppose there are only three states of the world and each state is equally likely to occur. The future local currency price of this asset (P*) as well as the future exchange rate (S) will be determined, depending on the realized state of the world.  Assume that you choose to "hedge" this asset by selling forward the expected value of the euro denominated cash flow at F1($/£) = $1.50/€. Calculate your cash flows in each of the possible states.

Assume that you choose to "hedge" this asset by selling forward the expected value of the euro denominated cash flow at F1($/£) = $1.50/€. Calculate your cash flows in each of the possible states.

Definitions:

Business Transaction

An economic event with a third party that is recorded in an organization's accounting system.

Accounting Records

Documents and books that keep track of the financial operations and transactions of an entity or individual, serving as evidence of financial performance and position.

Computer

An electronic device capable of processing, storing, and retrieving data, used for a wide range of tasks from computing to entertainment.

Double-Entry Bookkeeping System

An accounting technique which records each transaction in two accounts, ensuring the total debits equal total credits.

Q5: A call option to buy £10,000 at

Q19: The SF/$ spot exchange rate is SF1.25/$

Q25: How high does the lending rate in

Q39: Using the table above, what is the

Q68: Suppose that the one-year interest rate is

Q84: Which of the following conclusions are correct?<br>A)Most

Q87: A "three against nine" forward rate agreement<br>A)could

Q87: Which investment is likely to be the

Q89: Eurobonds are usually<br>A)bearer bonds.<br>B)registered bonds.<br>C)bulldog bonds.<br>D)foreign currency

Q98: Solnik (1984) examined the effect of exchange