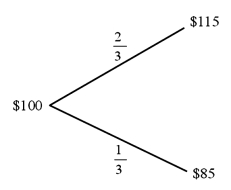

Find the value of a call option written on €100 with a strike price of $1.00 = €1.00. In one period there are two possibilities: the exchange rate will move up by 15% or down by 15% . The U.S. risk-free rate is 5% over the period. The risk-neutral probability of dollar depreciation is 2/3 and the risk-neutral probability of the dollar strengthening is 1/3.

Definitions:

Expert Systems

Artificial intelligence programs designed to solve complex problems by mimicking the decision-making abilities of human experts.

Finite Scheduling

A production planning method that allocates limited resources and time to specific tasks, considering the actual capacity and working hours available.

Batch Size

The quantity of items produced or processed in a single production run or batch.

Short-Term Scheduling

The process of organizing, managing, and allocating resources and tasks over a short time period to achieve specific objectives.

Q10: A foreign branch bank operates like a

Q13: Draw the tree for a put option

Q24: The major components of the Sarbanes-Oxley Act

Q25: How high does the lending rate in

Q35: On a reset date, floating-rate notes<br>A)experience very

Q38: Find the value of a one-year call

Q68: Which equation is used to define the

Q71: The core of the international money market

Q74: To hedge a foreign currency payable,<br>A)buy call

Q82: Invisible trade refers to<br>A)services that avoid tax