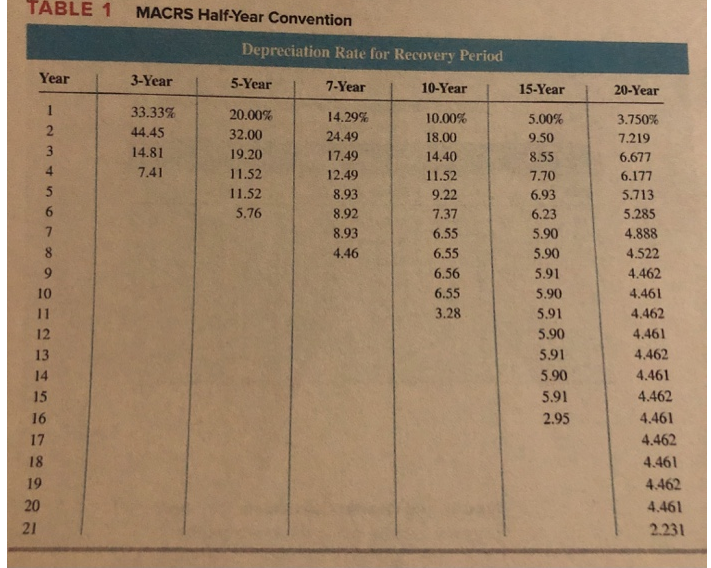

MACRS Table1

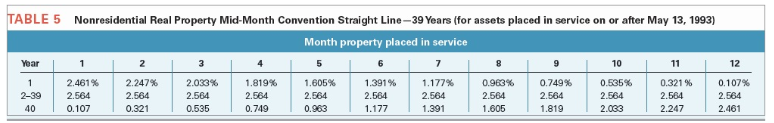

MACRS Table5

Exhibit 10-10 IN THE TEXT

-Boxer LLC has acquired various types of assets recently used 100% in its trade or business.Below is a list of assets acquired during 2017 and 2018:

Boxer did not elect §179 expense and elected out of bonus depreciation in 2017,but would like to take advantage of the §179 expense and bonus depreciation for 2018 (assume that taxable income is sufficient).Calculate Boxer's maximum depreciation expense for 2018.(Use MACRS Table 1,Table 5 and Exhibit 10-10 )(Round final answer to the nearest whole number.)

Definitions:

Spring Meeting

An annual or seasonal gathering, often related to work, organizational planning, or community events, held in the springtime.

Chemistry II

An advanced course in chemistry, typically covering more complex concepts and experiments beyond introductory levels.

Actors Improvised

When performers create spontaneous dialogue or action within the context of a performance without a script.

Scenes

Specific locations or settings where action takes place within a play, movie, book, or other narrative mediums.

Q6: Eddie purchased only one asset during the

Q23: Like financial accounting,most acquired business property must

Q27: Boxer LLC has acquired various types

Q28: Lisa and Collin are married.Lisa works as

Q44: Orchard,Inc.reported taxable income of $800,000 in year

Q59: Trudy is Jocelyn's friend.Trudy looks after Jocelyn's

Q68: Kristen rented out her home for

Q95: Generally,losses from rental activities are considered to

Q110: Corporations can carry net operating losses occurring in

Q119: Which of the following statements best describes