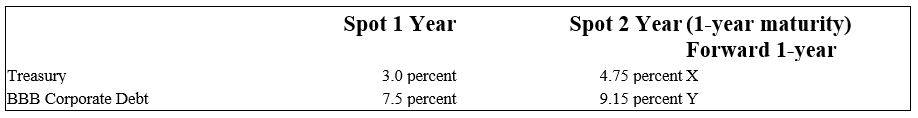

The following is information on current spot and forward term structures (assume the corporate debt pays interest annually) :

-The duration of a soon to be approved loan of $10 million is four years.The 99th percentile increase in risk premium for bonds belonging to the same risk category of the loan has been estimated to be 5.5 percent. If the fee income on this loan is 0.4 percent and the spread over the cost of funds to the bank is 1 percent,what is the expected income on this loan for the current year?

Definitions:

3-Month Olds

Infants who are approximately 90 days old, a developmental stage characterized by significant growth in sensory and motor abilities.

Biological

Pertaining to the science of life or living matter in all its forms and phenomena, especially with reference to origin, growth, reproduction, structure, and behavior.

Environmental

Relating to the natural world and the impact of human activity on its condition.

Multi-Word Utterances

Phrases or sentences composed of more than one word, significant in language development studies.

Q11: Property-casualty insurers tend to have a higher

Q11: Which of the following observations is NOT

Q19: Millon National Bank has 10 million British

Q31: In the event of financial distress,open-ended mutual

Q55: In the LCD and EM debt markets,sovereign

Q57: Foreign exchange rate risk occurs because foreign

Q57: The payments from an annuity offered by

Q66: The following is an example of a

Q94: A borrower's reputation is an example of

Q105: Credit risk stems from non-repayment or delays