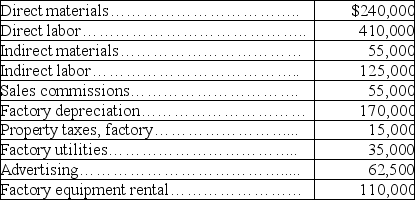

The predetermined overhead rate for Foster, Inc., is based on estimated direct labor costs of $400,000 and estimated factory overhead of $500,000. Actual costs incurred were:

(a) Calculate the predetermined overhead rate and calculate the overhead applied during the year.

(a) Calculate the predetermined overhead rate and calculate the overhead applied during the year.

(b) Determine the amount of over- or underapplied overhead and prepare the journal entry to eliminate the over- or underapplied overhead assuming that it is not material in amount.

Definitions:

Working Capital

The difference between a company's current assets and current liabilities, indicating the short-term liquidity and operational efficiency.

Carrying Costs

Expenses associated with holding or storing inventories, including warehousing, insurance, and spoilage costs.

Cash Inflows

The total amount of money being transferred into a business, often from operations, investments, or financing.

Net Working Capital

The difference between a company’s current assets and current liabilities, indicating its short-term financial health and ability to cover short-term liabilities.

Q22: Material amounts of under- or overapplied factory

Q29: A company has two products: A and

Q35: In a two person race,if the

Q78: Raw materials inventory should not include indirect

Q107: _, or customized production, produces products in

Q137: The purpose of managerial accounting information is

Q147: Job A3B was ordered by a customer

Q157: Dallas Company uses a job order costing

Q179: Last year, Flash Company sold 15,000 units

Q215: A company's prime costs total $4,500,000 and