Milton Company makes t-shirts.The shirts move through two departments during the production process.First,fabric is cut in the Cutting Department.The fabric pieces are then transferred to the Sewing Department where the shirts are assembled.The shirts are then sold to retail chains such as Wal-Mart and K-Mart.The following transactions apply to the company's operations during the current accounting period,which is its first year of operations,2014:

(a)Issued stock to shareholders for cash,$90,000.

(b)Purchased $30,000 of direct raw materials.

(c)Direct materials issued to the cutting and sewing departments,$10,000 and $2,000,respectively.

(d)Paid labor cost of $24,400.Direct labor usage for the cutting and assembly departments was $14,000 and $8,000,respectively.Indirect labor costs amounted to $2,400.

(e)Paid other overhead costs,$4,000.

(f)Applied overhead to production in both departments using the predetermined overhead rate of $0.30 per direct labor dollar.

(g)Transferred $21,000 of inventory from the Cutting Department to the Sewing Department.

(h)Transferred $30,400 of inventory from the Sewing Department to Finished Goods.

(i)Sold inventory costing $16,000 for $25,000 cash.

(j)Paid selling and administrative expenses,$5,000.

(k)Disposed of any underapplied or over-or-under-applied overhead.

Assume that all transactions are for cash unless otherwise stated.

Required:

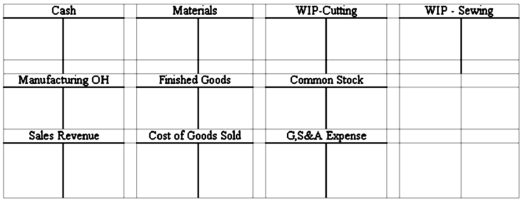

1)Record the transactions in the T-accounts provided.

2)Prepare a schedule of cost of goods manufactured and sold.

3)Compute the amount of gross margin that will be reported on the firm's year-end income statement.

Definitions:

Experiments

Controlled procedures carried out to discover, test, or demonstrate something within scientific or academic studies.

Surveys

Tools or methodologies for collecting data from respondents to gather insights on various topics or populations.

Quantitative Researchers

Specialists who focus on gathering and analyzing numerical data for statistical analysis to derive empirical insights and conclusions.

Hypothesis

A preliminary explanation suggested based on minimal evidence to initiate more detailed investigation.

Q29: Which ratio measures the percentage of company's

Q36: Willis Company made a $200,000 investment in

Q40: Which of the following is a traditional

Q51: Under the indirect method,which of the following

Q65: All of the following are additions to

Q77: Would issuing a mortgage to purchase a

Q97: An organizational unit of a business that

Q98: During February,Benke Manufacturing Company paid $18,000 in

Q124: Winken,Blinken,and Nod is a law firm specializing

Q127: A decrease in retained earningsRetained Earnings may