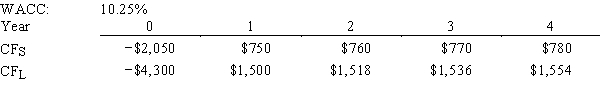

Projects S and L,whose cash flows are shown below,are mutually exclusive,equally risky,and not repeatable.Hooper Inc.is considering which of these two projects to undertake.If the decision is made by choosing the project with the higher IRR,how much value will be forgone? Note that under certain conditions choosing projects on the basis of the IRR will not cause any value to be lost because the project with the higher IRR will also have the higher NPV,so no value will be lost if the IRR method is used.

Definitions:

Lewis Terman

A psychologist known for his work in intelligence testing and the longitudinal study of gifted children.

WAIS

Wechsler Adult Intelligence Scale, a standardized test designed to measure intelligence in adults and older adolescents.

Working Memory

A newer understanding of short-term memory that adds conscious, active processing of incoming sensory information, and of information retrieved from long-term memory.

Achievement Test

A test designed to assess what a person has learned.

Q1: How would the Security Market Line be

Q7: Your consultant firm has been hired by

Q8: Refer to Exhibit 17.1.What is the value

Q10: Barette Consulting currently has no debt in

Q15: Which of the following statements is CORRECT?<br>A)In

Q26: Which of the following statements is CORRECT?<br>A)The

Q37: Nystrand Corporation's stock has an expected return

Q50: The company you just started has been

Q62: Carter & Carter is considering setting up

Q120: Net working capital,defined as current assets minus