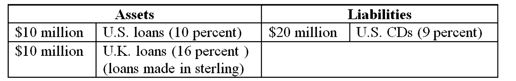

A U.S. FI is raising all of its $20 million liabilities in dollars (one-year CDs) but investing 50 percent in U.S. dollar assets (one-year maturity loans) and 50 percent in U.K. pound sterling assets (one-year maturity loans) . Suppose the promised one-year U.S. CD rate is 9 percent, to be paid in dollars at the end of the year, and that one-year, credit risk-free loans in the United States are yielding only 10 percent. Credit risk-free one-year loans are yielding 16 percent in the United Kingdom.

-If the spot foreign exchange rate remains constant at $1.60 to ≤1 throughout the year, the return from the U.K. investment will be

Definitions:

Male Hypoactive Sexual Desire Disorder

A sexual dysfunction characterized by a persistent or recurrent deficiency in sexual fantasies and desire for sexual activity in men.

Sexual Response Cycle

The sequence of physical and emotional changes that occur as a person becomes sexually aroused and participates in sexually stimulating activities, typically including phases such as excitement, plateau, orgasm, and resolution.

Sociocultural Cause

A factor originating from societal or cultural contexts that contributes to the development of a particular condition or behavior.

Performance Anxiety

Emotional or physical distress experienced before or during a performance in front of an audience, affecting the performer's ability to perform effectively.

Q9: Price volatility of a bond can be

Q15: Which of the following is the legislation

Q23: The U.S. Treasury has recently proposed that

Q25: FX trading income is derived only from

Q28: Estimate the standard deviation of Bank A's

Q37: If all interest rates decline 90 basis

Q40: Market value at risk (VAR) is defined

Q58: Banks whose loan portfolio composition deviates from

Q63: Which benefit of market risk measurement (MRM)

Q87: Profits in foreign exchange trading have grown