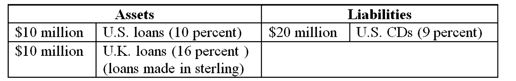

A U.S. FI is raising all of its $20 million liabilities in dollars (one-year CDs) but investing 50 percent in U.S. dollar assets (one-year maturity loans) and 50 percent in U.K. pound sterling assets (one-year maturity loans) . Suppose the promised one-year U.S. CD rate is 9 percent, to be paid in dollars at the end of the year, and that one-year, credit risk-free loans in the United States are yielding only 10 percent. Credit risk-free one-year loans are yielding 16 percent in the United Kingdom.

-If the exchange rate had fallen from $1.60/≤1 at the beginning of the year to $1.50/≤1 at the end of the year, the net interest margin for the FI on its balance sheet investments is

Definitions:

Forecasting

Forecasting involves making predictions about future events or trends based on current and historical data analysis.

Stakeholder Audit

An evaluation process that identifies and assesses the interests and influences of individuals or groups that have a stake in the outcomes of a project or company.

Evaluating Alternatives

The process of critically examining different options or courses of action to determine their potential effectiveness in achieving a desired outcome.

Making a Decision

The process of selecting a course of action from several alternatives.

Q14: Buyers are willing to purchase rescheduled LDC

Q25: What is the weighted average duration of

Q28: If the fee income on this loan

Q32: What is an important determinant of rescheduling

Q34: Which theory of term structure posits that

Q62: What is this FI's maturity gap?<br>A)4.00 years.<br>B)4.28

Q72: In the LCD and EM debt markets,

Q81: What is the probability that two-year B-rated

Q81: Prior to World War II, most international

Q85: Which of the following loan applicant characteristics