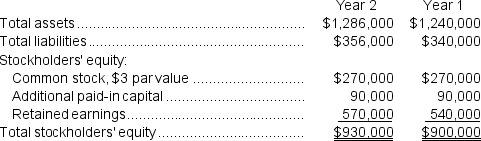

Vogelsberg Corporation has provided the following financial data:

The company's net operating income in Year 2 was $62,308; its interest expense was $12,000; and its net income was $32,700.Dividends on common stock during Year 2 totaled $2,700.The market price of common stock at the end of Year 2 was $6.37 per share.

The company's net operating income in Year 2 was $62,308; its interest expense was $12,000; and its net income was $32,700.Dividends on common stock during Year 2 totaled $2,700.The market price of common stock at the end of Year 2 was $6.37 per share.

Required:

a.What is the company's times interest earned ratio for Year 2?

b.What is the company's debt-to-equity ratio at the end of Year 2?

c.What is the company's equity multiplier at the end of Year 2?

d.What is the company's earnings per share for Year 2?

e.What is the company's price-earnings ratio for Year 2?

f.What is the company's dividend payout ratio for Year 2?

g.What is the company's dividend yield ratio for Year 2?

h.What is the company's book value per share at the end of Year 2?

Definitions:

Keebler, Inc.

An American cookie and former cracker manufacturer, known for its elfin characters and cookie varieties.

Common Stock

A type of security that signifies ownership in a corporation and represents a claim on part of the corporation's profits or losses.

Convertible Bond

A financial instrument that can be converted by the bondholder into a predetermined quantity of the issuer's company shares at certain intervals throughout the bond's life, generally at the bondholder's discretion.

Straight Bond Value

The value of a bond without any embedded options; it pays fixed interest and returns the principal at maturity.

Q22: (Ignore income taxes in this problem)The management

Q30: Which of the following refers to the

Q36: The total cash flow net of income

Q43: In general, the banking industry performed at

Q60: Rhoads Corporation is considering a capital budgeting

Q62: (Ignore income taxes in this problem.)Nevland Corporation

Q127: (Ignore income taxes in this problem.)Joanette,Inc.,is considering

Q136: The total cash flow net of income

Q158: Neither the net present value method nor

Q202: Braverman Corporation's net income last year was