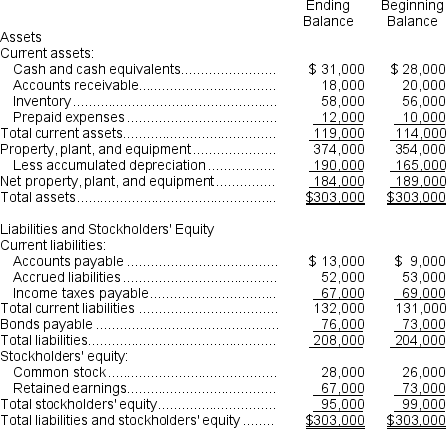

Krech Corporation's comparative balance sheet appears below:

The company's net income (loss) for the year was ($3,000) and its cash dividends were $3,000. It did not sell or retire any property, plant, and equipment during the year. The company uses the indirect method to determine the net cash provided by operating activities.

The company's net income (loss) for the year was ($3,000) and its cash dividends were $3,000. It did not sell or retire any property, plant, and equipment during the year. The company uses the indirect method to determine the net cash provided by operating activities.

-Which of the following is correct regarding the operating activities section of the statement of cash flows?

Definitions:

Performance Measures

Metrics or indicators used to assess the efficiency, effectiveness, and success of an organization's activities.

Net Operating Income

The profit generated from a company's everyday business operations, calculated by subtracting total operating expenses from total revenue.

Turnover

Refers to the rate at which inventory is sold and replaced or the volume of business conducted within a specific period, often used in analyzing business efficiency.

Return On Investment

A measure of financial performance calculated as the net profit divided by the total investment.

Q4: Evita Corporation prepares its statement of cash

Q6: Bonomo Corporation has provided the following information

Q21: The income tax expense in year 2

Q69: Which of the following statements is FALSE?<br>A)A

Q148: The company's operating cycle for Year 2

Q179: The payback period for the investment would

Q201: Kahn Corporation (a multi-product company)produces and sells

Q207: Moselle Corporation has provided the following financial

Q250: The current ratio at the end of

Q264: The company's times interest earned ratio for