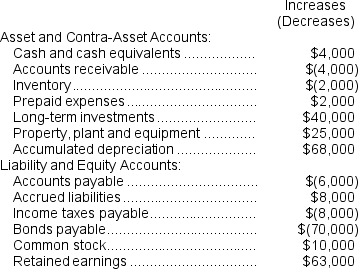

(Appendix 14A) The changes in Northrup Corporation's balance sheet account balances for last year appear below:

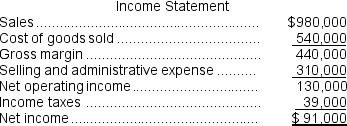

The company's income statement for the year appears below:

The company's income statement for the year appears below:

The company declared and paid $28,000 in cash dividends during the year. It did not dispose of any property, plant, and equipment during the year. The company uses the direct method to determine the net cash provided by (used in) operating activities.

The company declared and paid $28,000 in cash dividends during the year. It did not dispose of any property, plant, and equipment during the year. The company uses the direct method to determine the net cash provided by (used in) operating activities.

-On the statement of cash flows,the income tax expense adjusted to a cash basis would be:

Definitions:

Revenue Recognition

Accounting principle that determines the specific conditions under which income becomes realized as revenue.

Period Of Sale

The specific time during which a sale transaction is recognized in the accounting records, important for revenue recognition principles.

Completed-Contract Method

An accounting technique used to recognize revenue and expenses upon the completion of a contract, rather than progressively over its duration.

Partial Billings

Invoicing for a portion of a project or contract's value before the work is fully completed, typically used in long-term contracts.

Q9: (Ignore income taxes in this problem.)Gallatin,Inc.,has assembled

Q11: (Ignore income taxes in this problem.)Trovato Corporation

Q47: All of the following are examples of

Q66: If the internal rate of return is

Q72: Mattix Corporation's balance sheet and income statement

Q82: Porco Corporation is considering a capital budgeting

Q101: The total cash flow net of income

Q128: What is the financial advantage (disadvantage)to the

Q159: The company's return on total assets for

Q281: The company's equity multiplier at the end