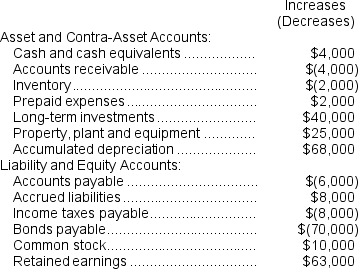

(Appendix 14A) The changes in Northrup Corporation's balance sheet account balances for last year appear below:

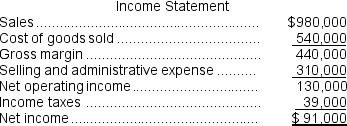

The company's income statement for the year appears below:

The company's income statement for the year appears below:

The company declared and paid $28,000 in cash dividends during the year. It did not dispose of any property, plant, and equipment during the year. The company uses the direct method to determine the net cash provided by (used in) operating activities.

The company declared and paid $28,000 in cash dividends during the year. It did not dispose of any property, plant, and equipment during the year. The company uses the direct method to determine the net cash provided by (used in) operating activities.

-On the statement of cash flows,the income tax expense adjusted to a cash basis would be:

Definitions:

Palpate Bladder

The physical examination technique of feeling the bladder through the abdominal wall to assess its size and fullness.

Distended by Urine

Describes a condition where a bladder or other area is stretched or swollen due to the accumulation of urine.

Nosocomial Infection

An infection acquired in a hospital or healthcare facility that was not present or incubating at the time of admission.

Indwelling Urinary Catheter

A tube inserted into the bladder to allow continuous urine drainage, used for patients who cannot void naturally.

Q13: The ending balance of accounts receivable was

Q19: The acid-test ratio is usually greater than

Q24: Vanik Corporation currently has two divisions which

Q39: The income tax expense in year 2

Q64: The company's equity multiplier at the end

Q97: (Ignore income taxes in this problem.)Slomkowski Corporation

Q131: One of the employees of Davenport Corporation

Q149: Arkin Corporation's total current assets are $290,000,its

Q196: Avoidable costs are irrelevant costs in decisions.

Q198: Banfield Corporation makes three products that use