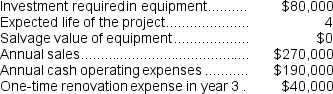

(Appendix 13C) Mesko Corporation has provided the following information concerning a capital budgeting project:

The company's income tax rate is 35% and its after-tax discount rate is 15%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The company's income tax rate is 35% and its after-tax discount rate is 15%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 2 is:

Definitions:

Inducements

Incentives or rewards offered to employees or other parties to motivate desired behaviors or actions.

Attribution

The process of explaining the causes or reasons behind behaviors or events, often referring to the assessment of responsibility or blame.

Explaining Events

The process of providing reasons or causes for occurrences, aiming to make sense of why things happen in the way they do.

Psychological Contract

The unwritten and unspoken expectations, beliefs, and assumptions about the reciprocal obligations between employees and their employer.

Q11: (Ignore income taxes in this problem.)A company

Q33: The net cash provided by (used in)financing

Q34: Shilt Corporation is considering a capital budgeting

Q67: The income tax expense in year 3

Q70: Rank the projects according to the profitability

Q88: Penniston Corporation is considering a capital budgeting

Q98: Which one of the following transactions should

Q147: The income tax expense in year 2

Q160: The SP Corporation makes 40,000 motors to

Q283: The company's return on equity for Year