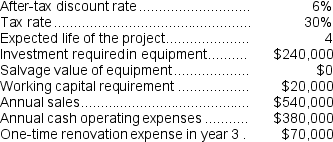

(Appendix 13C) Vanzant Corporation has provided the following information concerning a capital budgeting project:

The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 2 is:

Definitions:

Damages

Financial compensation awarded to a party in a lawsuit for loss or injury caused by the actions of another.

Plaintiff

The party who initiates a lawsuit or legal action against another party (the defendant) in a court of law, alleging harm or infringement of rights.

Superseding Cause

An intervening cause that alters the natural sequence of events and relieves the original party from liability in a legal context.

Causal Chain

A sequence of events where each event is the result of the previous one and causes the next, often used in legal and philosophical arguments.

Q4: (Ignore income taxes in this problem.)You have

Q6: Wister Corporation had sales of $462,000 for

Q18: Adah Corporation prepares its statement of cash

Q25: The absorption costing approach to cost-plus pricing

Q45: The following transactions occurred last year at

Q60: Under the indirect method of determining the

Q83: The company's price-earnings ratio is closest to:<br>A)

Q127: Przewozman Corporation has provided the following information

Q140: What is the net operating income for

Q212: Financial statements for Rardin Corporation appear below:<br>