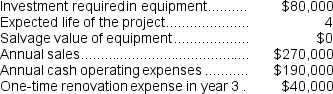

(Appendix 13C) Mesko Corporation has provided the following information concerning a capital budgeting project:

The company's income tax rate is 35% and its after-tax discount rate is 15%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The company's income tax rate is 35% and its after-tax discount rate is 15%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 2 is:

Definitions:

Applied Overhead

The process of assigning a portion of estimated overhead cost to specific production jobs or departments based on a predetermined rate.

Actual Overhead

includes the real, as incurred, indirect costs associated with manufacturing a product or providing a service, including utilities and rent.

Cost Allocation

The process of assigning indirect cost to a cost object, such as a job.

Factory Overhead

The indirect costs associated with manufacturing, including utilities, maintenance, and salaries of employees not directly involved in production.

Q4: Free cash flow decreases when a company

Q31: Payment of overtime to a worker in

Q36: The net cash provided by (used in)investing

Q48: (Ignore income taxes in this problem.)The management

Q87: Beltram Corporation's balance sheet and income statement

Q89: The net cash provided by (used in)operating

Q106: Aboud Industrial Products Inc.has developed a new

Q114: Autry Corporation's balance sheet and income statement

Q145: The income tax expense in year 3

Q158: The company's net profit margin percentage for