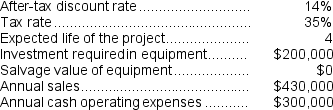

(Appendix 13C) Rollans Corporation has provided the following information concerning a capital budgeting project:

The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The total cash flow net of income taxes in year 2 is:

Definitions:

Liability

A financial obligation or amount owed by a business or individual to another entity.

Account Receivable

Funds that customers owe to a business for products or services they have received but have not paid for.

Customer's Check

A written, dated, and signed instrument that directs a bank to pay a specific sum of money to the bearer or the order of a person, company, or entity.

Sarbanes-Oxley Act

A U.S. law enacted in 2002 to protect investors by improving the accuracy and reliability of corporate disclosures.

Q9: Residual income can be used most effectively

Q22: Maloney Corporation's balance sheet and income statement

Q23: Which of the following items are included

Q28: (Ignore income taxes in this problem.)The management

Q30: What is the financial advantage (disadvantage)of purchasing

Q68: An advantage of using ROI to evaluate

Q105: When computing the net cash provided by

Q117: Wiswell Inc.reported the following results from last

Q126: (Ignore income taxes in this problem.)Cannula Vending

Q184: How much of the unit product cost