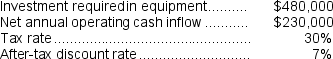

Rapozo Corporation has provided the following information concerning a capital budgeting project:

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value.The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $160,000 per year.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting.The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value.The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $160,000 per year.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting.The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

Required:

Determine the net present value of the project.Show your work!

Definitions:

Commercialization

The process of taking a new product or service to the market, introducing it to consumers, and making it available for purchase.

Test Marketing

The process of launching a new product or service to a limited geographical area to gauge its viability before a full-scale launch.

Maturity Stage

A phase in the product life cycle where sales growth slows down, and the product is well established in the market.

Growth Stage

A phase in the product life cycle characterized by rapid market acceptance and increasing profits.

Q4: The total cash flow net of income

Q38: If machine hours are the constraint,then the

Q44: Chene Corporation has provided the following information

Q45: The following transactions occurred last year at

Q52: Skowyra Corporation has provided the following information

Q68: (Ignore income taxes in this problem.)Maxcy Limos,Inc.,is

Q103: Partin Corporation's cash and cash equivalents consist

Q112: Assume that the total traceable fixed expense

Q137: Management is considering increasing the price of

Q141: At what selling price would the new