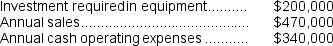

Chene Corporation has provided the following information concerning a capital budgeting project: The equipment will have a 4 year expected life and zero salvage value.The company's income tax rate is 35% and the after-tax discount rate is 10%.The company uses straight-line depreciation on all equipment; the annual depreciation expense will be $50,000.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting.

The equipment will have a 4 year expected life and zero salvage value.The company's income tax rate is 35% and the after-tax discount rate is 10%.The company uses straight-line depreciation on all equipment; the annual depreciation expense will be $50,000.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting.

The net present value of the project is closest to:

Definitions:

Chief Financial Officer

A senior executive responsible for managing the financial actions of a company, including financial planning, risk management, and record-keeping.

Treasurer

A person responsible for managing the treasury of an organization, including its financial liquidity, investments, and risk management.

Financial Manager

A professional responsible for overseeing an organization's financial health, including planning, risk management, and reporting.

Financial Plan

A comprehensive evaluation of an individual’s or organization’s current and future financial state by using currently known variables to predict future cash flows, asset values, and withdrawal plans.

Q3: Assume that the total traceable fixed expense

Q6: (Ignore income taxes in this problem.)Mattice Corporation

Q30: The net present value of the overhaul

Q51: (Ignore income taxes in this problem.)Jark Corporation

Q79: The company's return on equity for Year

Q90: Product U23N has been considered a drag

Q112: (Ignore income taxes in this problem.)The Zingstad

Q113: The net present value of the entire

Q124: (Ignore income taxes in this problem.)Tiff Corporation

Q153: If direct labor hours are the constraint,then