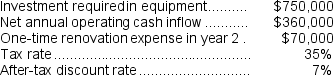

Sester Corporation has provided the following information concerning a capital budgeting project:

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value.The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $250,000 per year.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting.The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value.The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $250,000 per year.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting.The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

Required:

Determine the net present value of the project.Show your work!

Definitions:

Bully

An individual who uses strength or power to harm or intimidate those who are weaker.

Academic Performance

The measure of a student's scholastic activities and achievements, often reflected in grades and academic standing.

Experimenter Bias

involves the influence of the researcher's expectations or preferences on the outcomes of an experiment, potentially skewing the results.

Social Desirability Bias

The inclination of individuals to respond to queries in a way that they believe will be positively perceived by others.

Q3: When a company has a production constraint,the

Q11: Rapson Pure Water Solutions Corporation has developed

Q16: Duma Corporation has provided the following information

Q43: Degeare Corporation's balance sheet and income statement

Q50: Buzby Corporation manufactures numerous products,one of which

Q61: What is the financial advantage (disadvantage)of Alternative

Q67: From a value-based pricing standpoint what is

Q86: Byerly Corporation has provided the following data

Q133: Bungert Inc.reported the following results from last

Q136: Glover Company makes three products in a