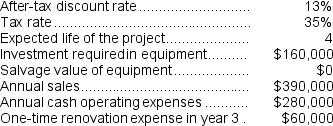

Bratton Corporation has provided the following information concerning a capital budgeting project: The company uses straight-line depreciation on all equipment; the annual depreciation expense will be $40,000.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting.

The company uses straight-line depreciation on all equipment; the annual depreciation expense will be $40,000.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting.

The net present value of the project is closest to:

Definitions:

Human Resources Manager

A professional responsible for overseeing the recruitment, training, and welfare of the company's employees, and managing aspects related to employment law and organizational policies.

Policy Formulation

The development of strategies and guidelines to address specific issues within an organization or a government.

Implementation

The process of putting plans, policies, or systems into action or effect within an organization or structure.

Sustainable Competitive Advantage

A long-term advantage that a company possesses, making it more competitive than others and difficult to replicate.

Q13: The total cash flow net of income

Q43: (Ignore income taxes in this problem.)The management

Q46: The company has received a special,one-time-only order

Q54: Rank the products in order of their

Q105: The net present value of the entire

Q111: The total cash flow net of income

Q136: The company's price-earnings ratio for Year 2

Q181: Assume the company has 50 units left

Q189: The times interest earned ratio for Year

Q275: Two-Rivers Inc.(TRI)manufactures a variety of consumer products.The