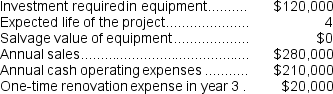

Newfield Corporation has provided the following information concerning a capital budgeting project:

The company uses straight-line depreciation.The depreciation expense will be $30,000 per year.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting.The income tax rate is 35% and the after-tax discount rate is 13%.

The company uses straight-line depreciation.The depreciation expense will be $30,000 per year.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting.The income tax rate is 35% and the after-tax discount rate is 13%.

Required:

Determine the net present value of the project.Show your work!

Definitions:

Detrimental Effects

Negative impacts or outcomes that result from a particular action or set of conditions.

Developed Markets

Countries with highly industrialized economies, well-developed financial markets, and high standards of living.

Wage-related Expenses

Costs incurred by employers that are directly associated with the payment of wages to employees, including taxes, benefits, and insurance.

Socioeconomic Inequality

The disparities in income, wealth, and access to resources among different social and economic groups within a society.

Q33: In the absorption approach to cost-plus pricing,the

Q51: (Ignore income taxes in this problem.)Jark Corporation

Q76: The book value of an old machine

Q78: Last year's residual income was closest to:<br>A)

Q87: The Wyeth Corporation produces three products,A,B,and C,from

Q105: Which product makes the LEAST profitable use

Q120: (Ignore income taxes in this problem.)A company

Q150: If investment funds are limited,the net present

Q162: Ignoring any salvage value,to the nearest whole

Q167: Selma Inc.reported the following results from last