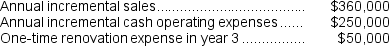

Yau Corporation is considering a capital budgeting project that would require investing $120,000 in equipment with a 4 year useful life and zero salvage value.Data concerning that project appear below:

An investment of $20,000 in working capital would be required immediately and would be released for use elsewhere at the end of the project.The company uses straight-line depreciation on all equipment.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting.The company's tax rate is 30% and the after-tax discount rate is 9%.

An investment of $20,000 in working capital would be required immediately and would be released for use elsewhere at the end of the project.The company uses straight-line depreciation on all equipment.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting.The company's tax rate is 30% and the after-tax discount rate is 9%.

Required:

Determine the net present value of the project.Show your work!

Definitions:

Systemic Evolution

Describes the process of change and development within a system, particularly in the context of complex systems and societies.

Differentiation

In sociology, differentiation refers to the process by which institutions and social processes become increasingly specialized and distinct from one another in modern societies.

Latency

A phase or period of inactivity or dormancy where underlying processes are not yet visible or are developing below the surface.

Pattern Maintenance

The process of preserving social systems and structures through the perpetuation of norms, values, and rituals.

Q21: Clayborn Corporation's net cash provided by operating

Q45: The income tax expense in year 2

Q54: The net present value of the entire

Q54: When the net cash inflow is the

Q66: The markup over cost under the absorption

Q87: Hawthorn Corporation has provided the following information

Q95: The income tax expense in year 2

Q116: Mike Corporation uses residual income to evaluate

Q119: Negative free cash flow suggests that the

Q127: From a value-based pricing standpoint what range