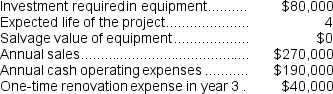

(Appendix 13C) Mesko Corporation has provided the following information concerning a capital budgeting project:

The company's income tax rate is 35% and its after-tax discount rate is 15%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The company's income tax rate is 35% and its after-tax discount rate is 15%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The total cash flow net of income taxes in year 3 is:

Definitions:

Q4: Brissett Corporation makes three products that use

Q20: The total cash flow net of income

Q64: Ritner Corporation manufactures a product that has

Q74: Morbeck Corporation's net income last year was

Q95: The net cash provided by (used in)investing

Q95: (Ignore income taxes in this problem.)The management

Q126: Gama Avionics Corporation has developed a new

Q131: (Ignore income taxes in this problem.)The following

Q177: A project has an initial investment of

Q177: Move time is considered non-value-added time.