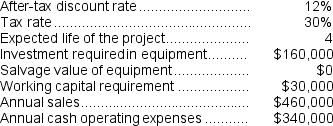

(Appendix 13C) Waltermire Corporation has provided the following information concerning a capital budgeting project:

The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The net present value of the entire project is closest to:

Definitions:

Implicit Costs

The opportunity costs of using resources owned by the company for its own operations, rather than earning income elsewhere.

Explicit Costs

Direct payments made to others in the course of running a business, such as wages, rent, and materials.

Implicit Costs

Costs that represent foregone opportunities, such as the income a business owner forgoes by investing in their own company instead of elsewhere.

Explicit Costs

Directly incurred expenses in the operation of a business, such as wages, rent, and material costs, which are clearly accounted for and easy to identify.

Q7: The company's return on equity for Year

Q25: The net cash provided by (used in)investing

Q40: On the statement of cash flows,the sales

Q50: Buzby Corporation manufactures numerous products,one of which

Q71: Shanks Corporation is considering a capital budgeting

Q81: The net present value of the entire

Q84: The net present value of the alternative

Q125: Petro Corporation has provided the following information

Q163: What is the maximum amount the company

Q172: If Elly industries is able to obtain