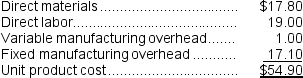

Ahrends Corporation makes 70,000 units per year of a part it uses in the products it manufactures. The unit product cost of this part is computed as follows:

An outside supplier has offered to sell the company all of these parts it needs for $48.50 a unit. If the company accepts this offer, the facilities now being used to make the part could be used to make more units of a product that is in high demand. The additional contribution margin on this other product would be $273,000 per year.

An outside supplier has offered to sell the company all of these parts it needs for $48.50 a unit. If the company accepts this offer, the facilities now being used to make the part could be used to make more units of a product that is in high demand. The additional contribution margin on this other product would be $273,000 per year.

If the part were purchased from the outside supplier, all of the direct labor cost of the part would be avoided. However, $8.20 of the fixed manufacturing overhead cost being applied to the part would continue even if the part were purchased from the outside supplier. This fixed manufacturing overhead cost would be applied to the company's remaining products.

-What is the maximum amount the company should be willing to pay an outside supplier per unit for the part if the supplier commits to supplying all 70,000 units required each year?

Definitions:

Mean Value

The average of a set of numbers, calculated by dividing the sum of all the numbers by the count of the numbers.

Mode

The mode, or the value with the highest frequency, in a set of numbers.

Males

Refers to the male gender or sex, typically used in studies or statistics to denote participants or subjects that are biologically male.

Females

Females refer to the sex of an organism, or a part of an organism, that produces non-mobile ova (egg cells) and can typically bear offspring or produce seed.

Q20: Tabarez Corporation's Maintenance Department provides services to

Q37: A study has been conducted to determine

Q42: A joint product is:<br>A) any product which

Q53: Throughput time is the amount of time

Q73: If a company contains a number of

Q135: Priddy Corporation processes sugar cane in batches.The

Q147: The income tax expense in year 2

Q157: The manufacturing cycle efficiency (MCE)was closest to:<br>A)

Q157: (Ignore income taxes in this problem.)Ramson Corporation

Q159: (Ignore income taxes in this problem.)Laws Corporation