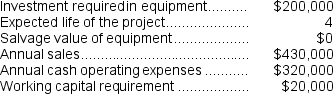

(Appendix 13C) Reye Corporation has provided the following information concerning a capital budgeting project:

The company's income tax rate is 30% and its after-tax discount rate is 9%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The company's income tax rate is 30% and its after-tax discount rate is 9%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The total cash flow net of income taxes in year 2 is:

Definitions:

Marginal Cost

The cost incurred by producing one additional unit of a good or service, crucial for decision-making in production and pricing strategies.

Total Cost

The complete cost of producing a specific quantity of output, combining both fixed and variable costs.

Marginal Cost

The additional cost incurred by producing one more unit of a product or service, crucial for economic decision-making and pricing strategies.

Diminishing Marginal Product

The principle that as more of a variable input is added to a fixed input, the additional output gained from each new unit of input will eventually decrease.

Q33: How many minutes of grinding machine time

Q71: Shanks Corporation is considering a capital budgeting

Q80: The following transactions occurred last year at

Q80: Patenaude Corporation has provided the following information

Q87: Hawthorn Corporation has provided the following information

Q108: Management is considering decreasing the price of

Q116: The net present value of the entire

Q147: The income tax expense in year 2

Q171: The simple rate of return for the

Q185: The annual financial advantage (disadvantage)for the company