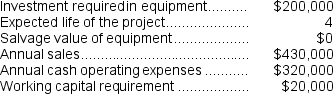

(Appendix 13C) Reye Corporation has provided the following information concerning a capital budgeting project:

The company's income tax rate is 30% and its after-tax discount rate is 9%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The company's income tax rate is 30% and its after-tax discount rate is 9%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The net present value of the entire project is closest to:

Definitions:

Product-Development Team

A group of individuals, often cross-functional, working together to develop new products or improve existing ones.

Q11: The total cash flow net of income

Q32: Respass Corporation has provided the following data

Q33: In the absorption approach to cost-plus pricing,the

Q58: An increase in accrued liabilities of $1,000

Q86: Byerly Corporation has provided the following data

Q99: Klicker Corporation's most recent balance sheet appears

Q126: Gama Avionics Corporation has developed a new

Q142: Suire Corporation is considering dropping product D14E.Data

Q147: Most of the opportunities to reduce the

Q150: If investment funds are limited,the net present