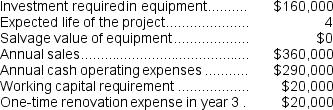

(Appendix 13C) Layer Corporation has provided the following information concerning a capital budgeting project:

The company's income tax rate is 30% and its after-tax discount rate is 8%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The company's income tax rate is 30% and its after-tax discount rate is 8%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The total cash flow net of income taxes in year 3 is:

Definitions:

Commercial Transaction

An exchange of goods, services, or funds between parties in a business context.

Social Inequality

The uneven distribution of resources, opportunities, and rights among different social statuses and groups in a society.

Group Autonomy

The right or condition of self-governance by a group, often within a larger political or social entity, that allows the group to manage its own affairs independently.

Mutual Obligation

A concept in social policy where the rights of individuals to receive certain benefits or support are conditioned upon their performance of specific duties or behaviors.

Q29: In a statement of cash flows,a change

Q31: Ladle Corporation uses the absorption costing approach

Q34: Shilt Corporation is considering a capital budgeting

Q36: If product B is processed beyond the

Q88: The income tax expense in year 3

Q122: Are the materials costs and processing costs

Q141: Minden Corporation estimates that the following costs

Q167: Selma Inc.reported the following results from last

Q201: Kahn Corporation (a multi-product company)produces and sells

Q216: Perrett Corporation has provided the following financial