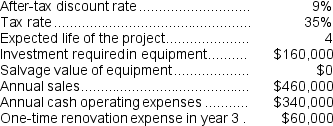

(Appendix 13C) Marbry Corporation has provided the following information concerning a capital budgeting project:

The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 2 is:

Definitions:

Radiation Exposure

The condition of being exposed to radiant energy or particles such as x-rays, gamma rays, or neutrons, which can have health implications.

Lead Barrier

A protective structure or shield made of lead, designed to prevent radiation from passing through.

Radiodermatitis

A skin condition caused by exposure to radiation, often seen as a side effect in patients undergoing radiation therapy for cancer.

Inflammation

A protective response involving immune cells, blood vessels, and molecular mediators that aims to eliminate the initial cause of cell injury, clear out damaged cells and tissues, and establish repair.

Q8: The income tax expense in year 2

Q10: Basey Corporation has provided the following data

Q36: The total cash flow net of income

Q37: The total cash flow net of income

Q51: (Ignore income taxes in this problem.)Jark Corporation

Q86: The target cost per unit is closest

Q93: The following events occurred last year for

Q96: Stomberg Corporation has provided the following data

Q103: Partin Corporation's cash and cash equivalents consist

Q124: Kaeser Corporation's most recent balance sheet appears