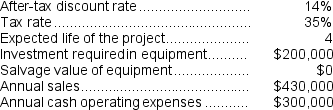

(Appendix 13C) Rollans Corporation has provided the following information concerning a capital budgeting project:

The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The total cash flow net of income taxes in year 2 is:

Definitions:

Grave Disability

A condition in which an individual, due to mental illness, is unable to provide for their basic personal needs for food, clothing, or shelter.

Need for Treatment

The requirement for medical care or therapy to address health or psychological issues.

Grave Disability

A condition where an individual is unable to take care of basic personal needs due to a mental disorder.

O'Connor v. Donaldson

A landmark legal case in which the U.S. Supreme Court ruled that a state cannot constitutionally confine a non-dangerous individual who is capable of surviving safely in freedom by themselves or with the help of willing and responsible family members or friends.

Q4: Brissett Corporation makes three products that use

Q7: (Ignore income taxes in this problem.)Ursus,Inc.,is considering

Q13: The total cash flow net of income

Q27: The income tax expense in year 3

Q83: If the present bus is repaired,the present

Q112: (Ignore income taxes in this problem.)The Zingstad

Q135: (Ignore income taxes in this problem.)Welch Corporation

Q144: From a value-based pricing standpoint what is

Q144: The investment in working capital at the

Q149: Two products,QI and VH,emerge from a joint