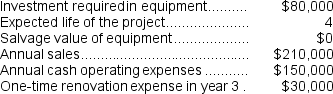

(Appendix 13C) Planas Corporation has provided the following information concerning a capital budgeting project:

The company's income tax rate is 35% and its after-tax discount rate is 14%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The company's income tax rate is 35% and its after-tax discount rate is 14%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 3 is:

Definitions:

Legend Position

Refers to the location within a chart or graph where the legend, explaining symbols or colors used, is placed.

Paste Arrow

A graphical indicator used in user interfaces that shows where content will be inserted when pasted from the clipboard.

Link Option

A feature in various software applications that allows users to create hyperlinks, connecting text or objects to other sections of the same document, another document, or a webpage.

Hide Source Documents

The process of concealing original documents or data sources, often for security or confidentiality reasons.

Q12: The total cash flow net of income

Q17: The total cash flow net of income

Q47: (Ignore income taxes in this problem.)Whitton Corporation

Q102: (Ignore income taxes in this problem.)Ducey Corporation

Q111: Braymiller Inc.has a $1,600,000 investment opportunity with

Q130: (Ignore income taxes in this problem)The management

Q150: The income tax expense in year 3

Q161: Assume that sufficient constraint time is available

Q177: Garson,Inc.produces three products.Data concerning the selling prices

Q200: Lakeshore Tours Inc.,operates a large number of