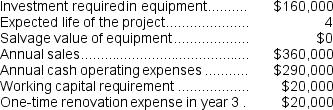

(Appendix 13C) Layer Corporation has provided the following information concerning a capital budgeting project:

The company's income tax rate is 30% and its after-tax discount rate is 8%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The company's income tax rate is 30% and its after-tax discount rate is 8%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The total cash flow net of income taxes in year 2 is:

Definitions:

Congenital

Pertaining to conditions or traits present from birth, either inherited or caused by environmental factors.

Meningitis

The inflammation of the protective membranes covering the brain and spinal cord, potentially caused by infection.

Membranes

Thin layers of tissue that cover surfaces, line cavities, and separate spaces or organs within the body.

Parkinson Disease

A progressive neurological disorder characterized by movement problems such as tremors, stiffness, and slowed movement.

Q23: The income tax expense in year 2

Q31: Shoshoni Corporation prepares its statement of cash

Q60: (Ignore income taxes in this problem.)The management

Q93: What is the net operating income for

Q96: Companies often allocate common fixed costs among

Q104: The net cash provided by (used in)investing

Q106: Paying wages and salaries to employees is

Q134: In net present value analysis,the release of

Q137: The total cash flow net of income

Q157: (Ignore income taxes in this problem.)Ramson Corporation