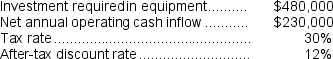

Condo Corporation has provided the following information concerning a capital budgeting project:

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value.The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $160,000 per year.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting.The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value.The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $160,000 per year.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting.The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

Required:

Determine the net present value of the project.Show your work!

Definitions:

Budget Deficits

A financial situation where a government's expenditures exceed its revenues, leading to increased borrowing or reduced spending.

Public Debt

The total amount owed by the federal government to the owners of government securities; equal to the sum of past government budget deficits less government budget surpluses.

Regulatory Capture

A situation where regulatory agencies are dominantly influenced by the industries they are charged with regulating, often leading to biased decisions favoring industry.

Government Agency

A permanent or semi-permanent organization in the machinery of government that is responsible for the oversight and administration of specific functions, such as an agency of the federal or state government.

Q2: Kanzler Corporation is considering a capital budgeting

Q12: The total cash flow net of income

Q15: The total cash flow net of income

Q24: The net present value of Project B

Q36: If product B is processed beyond the

Q43: Suppose there is ample idle capacity to

Q82: Cash payments to repay the principal amount

Q97: The net cash provided by (used in)financing

Q103: Cables Electronics Corporation has developed a new

Q197: What is the financial advantage (disadvantage)for the