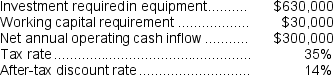

Ariel Corporation has provided the following information concerning a capital budgeting project:

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value.The working capital would be required immediately and would be released for use elsewhere at the end of the project.The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $210,000 per year.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting.The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value.The working capital would be required immediately and would be released for use elsewhere at the end of the project.The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $210,000 per year.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting.The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

Required:

Determine the net present value of the project.Show your work!

Definitions:

Subculture

An identifiable community within a larger societal framework, characterized by unique beliefs or interests that differ from the mainstream culture.

Hacktivists

Individuals who use computer hacking skills for activism purposes, often to promote political ends or social justice.

Bodybuilders

Individuals who engage in intensive physical training and dieting to develop and maintain an aesthetically muscular physique, often for competitive display.

Multiculturalism

A policy or ideology that promotes the inclusion, representation, and rights of diverse cultural groups within a society.

Q3: Assume that the total traceable fixed expense

Q4: Brissett Corporation makes three products that use

Q45: Jaakola Corporation makes a product with the

Q46: The company has received a special,one-time-only order

Q59: Kirsten Corporation makes 100,000 units per year

Q90: Management is considering decreasing the price of

Q105: The net present value of the entire

Q117: Wiswell Inc.reported the following results from last

Q119: Negative free cash flow suggests that the

Q153: (Ignore income taxes in this problem.)The management