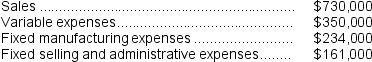

Product U23N has been considered a drag on profits at Jinkerson Corporation for some time and management is considering discontinuing the product altogether.Data from the company's budget for the upcoming year appear below: In the company's accounting system all fixed expenses of the company are fully allocated to products.Further investigation has revealed that $144,000 of the fixed manufacturing expenses and $93,000 of the fixed selling and administrative expenses are avoidable if product U23N is discontinued.The financial advantage (disadvantage) for the company of eliminating this product for the upcoming year would be:

In the company's accounting system all fixed expenses of the company are fully allocated to products.Further investigation has revealed that $144,000 of the fixed manufacturing expenses and $93,000 of the fixed selling and administrative expenses are avoidable if product U23N is discontinued.The financial advantage (disadvantage) for the company of eliminating this product for the upcoming year would be:

Definitions:

Code Of Ethics

The tool with which the owner of a business communicates ethical expectations to everyone associated with the business.

Environmental Analysis

The process of evaluating the external factors affecting an organization's operation, such as political, economic, social, and technological factors.

National And International

Terms that differentiate between phenomena, policies, or activities that occur within a single country (national) and those that occur across borders or worldwide (international).

Proposed Business Owners

Individuals or entities that are considering starting a new business venture.

Q18: Moates Corporation has provided the following data

Q46: Last year Anderson Corporation reported a cost

Q68: (Ignore income taxes in this problem.)Maxcy Limos,Inc.,is

Q70: What is the minimum amount the company

Q86: Byerly Corporation has provided the following data

Q88: Management is considering increasing the price of

Q137: Tadman Inc.reported the following results from last

Q138: The payback method is most appropriate for

Q158: Santoyo Corporation keeps careful track of the

Q167: The company has received a special,one-time-only order