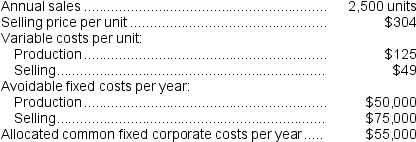

Key Corporation is considering the addition of a new product. The expected cost and revenue data for the new product are as follows:

If the new product is added, the combined contribution margin of the other, existing products is expected to drop $65,000 per year. Total common fixed corporate costs would be unaffected by the decision of whether to add the new product.

If the new product is added, the combined contribution margin of the other, existing products is expected to drop $65,000 per year. Total common fixed corporate costs would be unaffected by the decision of whether to add the new product.

-If the new product is added next year,the financial advantage (disadvantage) resulting from this decision would be:

Definitions:

Sales Revenues

The total amount of money generated from the sale of goods or services by a company before any costs or expenses are subtracted.

Cash Operating Expenses

Expenses that a company pays in cash during an accounting period, excluding non-cash expenses such as depreciation.

Net Present Value

A financial metric that calculates the difference between the present value of cash inflows and outflows over a period of time, used in capital budgeting to assess the profitability of an investment.

Discount Rate

The rate of interest utilized in the process of discounted cash flow analysis for assessing the present worth of future cash flows.

Q4: Verbeke Inc.reported the following results from last

Q34: From a value-based pricing standpoint what range

Q43: The throughput time was:<br>A) 4.6 hours<br>B) 9.7

Q45: The income tax expense in year 2

Q47: The income tax expense in year 3

Q74: Ohanlon Corporation manufactures numerous products,one of which

Q81: Rohrer Products,Inc.,has a Motor Division that manufactures

Q125: Which of the following would be relevant

Q141: When a company is cash poor,a project

Q144: The investment in working capital at the