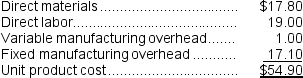

Ahrends Corporation makes 70,000 units per year of a part it uses in the products it manufactures. The unit product cost of this part is computed as follows:

An outside supplier has offered to sell the company all of these parts it needs for $48.50 a unit. If the company accepts this offer, the facilities now being used to make the part could be used to make more units of a product that is in high demand. The additional contribution margin on this other product would be $273,000 per year.

An outside supplier has offered to sell the company all of these parts it needs for $48.50 a unit. If the company accepts this offer, the facilities now being used to make the part could be used to make more units of a product that is in high demand. The additional contribution margin on this other product would be $273,000 per year.

If the part were purchased from the outside supplier, all of the direct labor cost of the part would be avoided. However, $8.20 of the fixed manufacturing overhead cost being applied to the part would continue even if the part were purchased from the outside supplier. This fixed manufacturing overhead cost would be applied to the company's remaining products.

-What is the financial advantage (disadvantage) of purchasing the part rather than making it?

Definitions:

Normal Accidents

The concept that in complex systems, accidents are unavoidable and inherent due to the intricate interactions and dependencies of system components.

Capital Investment

Money spent by a business entity to acquire or upgrade physical assets such as property, industrial buildings, or equipment to increase its long-term revenue.

Technical Experts

Individuals possessing specialized knowledge or skills in a specific field or technology, often consulted for their expertise.

Work Organization

The way in which work is structured and managed within workplaces, including the division of tasks, roles, and responsibilities.

Q20: The total cash flow net of income

Q29: For performance evaluation purposes,how much of the

Q62: Juliani Company produces a single product.The cost

Q78: Anglen Co.manufactures and sells trophies for winners

Q87: Hawthorn Corporation has provided the following information

Q111: The sensitivity of unit sales to changes

Q117: Ariel Corporation has provided the following information

Q122: Are the materials costs and processing costs

Q148: The minimum required rate of return is

Q160: (Ignore income taxes in this problem.)A company