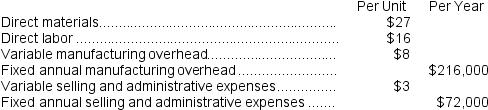

The management of Musselman Corporation would like to set the selling price on a new product using the absorption costing approach to cost-plus pricing. The company's accounting department has supplied the following estimates for the new product:

Management plans to produce and sell 9,000 units of the new product annually. The new product would require an investment of $1,305,000 and has a required return on investment of 10%.

Management plans to produce and sell 9,000 units of the new product annually. The new product would require an investment of $1,305,000 and has a required return on investment of 10%.

-The markup percentage on absorption cost is closest to:

Definitions:

Securities Act of 1934

U.S. federal law focusing on the regulation of the secondary trading of securities (stocks, bonds, and debentures) in the United States.

Scienter

A legal term used to refer to a party's knowledge of the wrongfulness or fraudulent nature of their actions.

Williams Act

A subset of the Securities Exchange Act of 1934, regulating tender offers and requiring disclosure of information by anyone seeking to acquire more than 5% of a company's securities.

Tender Offers

Public, open proposals by a party to purchase a substantial portion of a company’s shares or bonds from its shareholders or bondholders.

Q1: Assume that the Motor Division has enough

Q4: Verbeke Inc.reported the following results from last

Q15: The internal rate of return of the

Q32: How much (if any)of the $255,000 in

Q42: Infante Corporation has provided the following information

Q70: Cirone Inc.reported the following results from last

Q130: Variable costs are always relevant costs in

Q135: A capital budgeting project's incremental net income

Q148: The following information relates to last year's

Q211: The materials price variance for April is:<br>A)