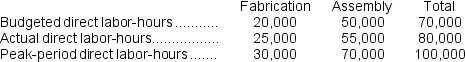

(Appendix 11B) Nafth Company has an Equipment Services Department that performs all needed maintenance work on the equipment in the company's Fabrication and Assembly Departments. Costs of the equipment Services Department are charged to the Fabrication and Assembly Departments on the basis of direct labor-hours. Data on direct labor-hours for last year follow:

For the year just ended, the company budgeted its variable maintenance costs at $210,000 for the year. Actual variable maintenance costs for the year totaled $255,000.

For the year just ended, the company budgeted its variable maintenance costs at $210,000 for the year. Actual variable maintenance costs for the year totaled $255,000.

-How much (if any) of the $255,000 in variable maintenance cost should not be charged to the Fabrication and Assembly Departments?

Definitions:

Times Interest Earned Ratio

A financial metric indicating how well a company can meet its interest obligations based on its earnings before interest and taxes.

Depreciation Expense

Dividing the expenditure of a solid asset over its effective life.

EBIT

Earnings Before Interest and Taxes, a financial metric that calculates a company's profitability from operations without the effects of interest and tax expenses.

Cash Coverage Ratio

A financial metric that measures a company's ability to cover its debt obligations with its cash and cash equivalents.

Q14: When the work in process is completed

Q18: Last year's margin was closest to:<br>A) 36.7%<br>B)

Q19: The raw materials quantity variance for the

Q42: Variable service department costs should be charged

Q56: Leete Inc.reported the following results from last

Q84: In value-based pricing,the value of what differentiates

Q109: From a value-based pricing standpoint what is

Q135: The markup percentage on absorption cost is

Q143: What is the financial advantage (disadvantage)for the

Q174: Brodrick Corporation uses residual income to evaluate