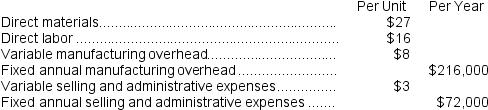

The management of Musselman Corporation would like to set the selling price on a new product using the absorption costing approach to cost-plus pricing. The company's accounting department has supplied the following estimates for the new product:

Management plans to produce and sell 9,000 units of the new product annually. The new product would require an investment of $1,305,000 and has a required return on investment of 10%.

Management plans to produce and sell 9,000 units of the new product annually. The new product would require an investment of $1,305,000 and has a required return on investment of 10%.

-The markup percentage on the new product would be closest to:

Definitions:

Behavioral Economics Research

Behavioral economics research studies the effects of psychological, cognitive, emotional, cultural, and social factors on the economic decisions of individuals and institutions and how those decisions vary from those implied by classical theory.

Anchoring Effect

A mental shortcut in which a person gives excessive weight to the first piece of information they receive (known as the "anchor") during decision-making processes.

Minimum Required Payment

The lowest amount that must be paid on an outstanding debt, such as a credit card bill, to avoid penalties.

Credit Card Companies

Financial institutions or corporations that issue credit cards to consumers, facilitating electronic payments and extending credit.

Q10: The income tax expense in year 3

Q13: What would be the financial advantage (disadvantage)from

Q24: Vanik Corporation currently has two divisions which

Q46: Tanouye Corporation keeps careful track of the

Q71: Bohmker Corporation is introducing a new product

Q110: The total cash flow net of income

Q127: Przewozman Corporation has provided the following information

Q169: What is the financial advantage (disadvantage)for the

Q181: Assume the company has 50 units left

Q190: Variable manufacturing overhead is applied to products