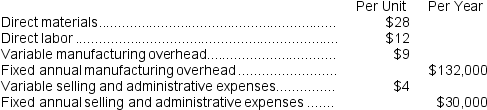

The management of Landstrom Corporation would like to set the selling price on a new product using the absorption costing approach to cost-plus pricing.The company's accounting department has supplied the following estimates for the new product:

Management plans to produce and sell 6,000 units of the new product annually.The new product would require an investment of $1,036,200 and has a required return on investment of 10%.

Management plans to produce and sell 6,000 units of the new product annually.The new product would require an investment of $1,036,200 and has a required return on investment of 10%.

Required:

a.Determine the unit product cost for the new product.

b.Determine the markup percentage on absorption cost for the new product.

c.Determine the selling price for the new product using the absorption costing approach.

Definitions:

Coping

The process of managing external or internal demands that are perceived as taxing or exceeding personal resources.

Rapid Change

A situation or event that evolves quickly over a short period of time, often with profound effects.

Continuance Commitment

Commitment based on the costs that would be incurred in leaving an organization or a lack of suitable job alternatives.

Pension Fund

A pool of funds accumulated to pay employees' retirement benefits, contributed by employers, employees, or both.

Q11: Waste on the production line will result

Q77: The income tax expense in year 3

Q90: Sester Corporation has provided the following information

Q103: Fixed costs are irrelevant in decisions about

Q110: Attal Corporation manufactures numerous products,one of which

Q129: The throughput time was:<br>A) 30.6 hours<br>B) 3.2

Q134: Maccarone Corporation manufactures numerous products,one of which

Q136: From a value-based pricing standpoint what is

Q165: If management decides to buy part U98

Q181: The materials price variance for November is:<br>A)